Players today are invariably drawn to casino games – games of fortune – and sports betting – games of skills. The trend of iGaming companies offering sports betting and poker, and some bookmakers reinforcing their brand with complementary casinos, poses several questions: who is the online gambling target audience? What is the difference between those who prefer casinos and those who prefer sports betting? As an operator, can you cater to both audiences with one brand?

We share unbiased insights from our clients and industry experts so that you could develop a truly winning business strategy for your sportsbook website and casino.

The Online Casino Target Audience: Young, Male, and Motivated

Casino Players vs. Sports Bettors: Detailed Comparison | SOFTSWISSIn other words, nearly one in three people is a potential casino guest, but such an abstract gambling portrait is simply not sufficient for business – let's look at a more detailed picture of the modern gambler.

Casino Player Profile

Hands down, stereotypes are not always irrelevant to tests. For example, the casino's target customers in 2024, in line with one of the most overused stereotypes, is still mostly young men. Obviously, it is difficult to generalise, and the situation can vary from market to market, but it is broadly consistent across different GEOs.

According to casino.org, 60% of all UK players are men, but the number of women, currently at 40%, is increasing to equalise. Women tend to prefer bingo-type games, however, there has been an upsurge in demand for slots as of late.

Casino Target Markets

A global pandemic in 2020 brought a great deal of harm to offline casinos while boosting the online gaming industry tremendously. According to Grand View Research, the online gambling market is estimated to be worth 63.53 billion US dollars and is projected to experience a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030.

In terms of distribution, Europe is expected to lead with a 53.2% share. An important driver in the development of this traditionally leading market remains the trend towards national regulation, which has been strongly reinforced by Germany, Sweden, and the Netherlands, previously accounted for by the remote gambling Malta Gaming Authority (MGA) licence. Since 2018, the number of online gambling licences in the region has been increasing.

The European online gambling regulation has always been quite dynamic; while one country opens up to online gambling, another introduces restrictions or begins work on local licensing. However, one trend stands out clearly – Europe is a mature and, at the same time, very promising market that is moving toward strong local regulatory frameworks and improving industry-government relations.

Despite certain cultural differences, Asia and the Middle East still hold a significant market share (27.8%). According to some sources, the overall value of the online gambling market in Asia is estimated to be 72 million USD. Without a doubt, the jurisdictional and regulatory situation looks challenging, yet growth prospects and a market share of almost 30% leave no room for neglecting the region.

Latin America is probably the most watched region this year. With favourable updates in the jurisdictional framework, the region is now witnessing significant growth in the gaming industry and ranks with a share of 1.3%, making it one of the best markets to target with an online casino.

Africa is the new Klondike for the online gambling & betting market. As a result of the region's continued economic growth, the sports industry's strong interest, and improving telecommunication and internet conditions, it makes a great market for bookmakers. Globally, Africa contributes 1.1% to online gambling with a growth forecast. Sub-Saharan Africa's policy on online gambling determines the strategies of businesses looking to enter this market.

Casino Players vs. Sports Bettors: Detailed Comparison | SOFTSWISSTraditionally, slots have captured the hearts of players around the world for decades now – different genres, graphics, and bonus policies keep this classic game from becoming stale as it re-emerges in new contexts. An important part of any casino's portfolio is what is known as a skill game – table games. Poker, blackjack and baccarat on a live or RNG basis have a loyal following among those seeking to develop their logic and analytical abilities.

Fish games are also becoming increasingly popular, especially in Asia. No matter how realistic or graphic the elements are, the catch-the-fish-type game appeals to players who value tactics and progression in a game, as the elements, aka fishes, constantly move and demand players' attention.

Casino Players vs. Sports Bettors: Detailed Comparison | SOFTSWISS

Player Motivation

Creating a dynamic casino audience without the signs of compulsive gambling requires understanding the true motives of your target players.

Casino Players vs. Sports Bettors: Detailed Comparison | SOFTSWISSSome of the most common factors that influence casino players' engagement include

- Social aspect

Traditionally, brick-and-mortar casinos were a great way to socialise, establish status, and meet new people. As the online casino market developed, its direct role in in-person socialisation gradually declined; it was not completely lost but transformed. Today’s casinos are surrounded by various communities, forums, chat rooms, and live dealer activities designed to maintain a sense of presence. - Psychological factors

In a sense, gambling is an antidote to routine, an activity that saturates life with new emotions and colours. The desire to win, the adrenaline rush, and the excitement are the dopamine hooks that lure players in. - Earning ambition

Some players view casino games as a way to make money and improve their standard of living. When players rely on luck, leave relatively small amounts at the casino, and always have a chance to break even, it gives the impression that casinos are money-making machines, which isn't the case. Usually, this motivation leads to addictive and destructive behaviour, so it is prudent to monitor player patterns according to Responsible Gambling policies in order to prevent future problems.

The Target Audience for Sports Betting: Football-Focused and Tech-Savvy

Casino Players vs. Sports Bettors: Detailed Comparison | SOFTSWISSOnline Sports Bettor Profile

Globally, the situation in sports betting remains similar – young and tech-savvy men dominate. According to the FSGA research, at the moment, the audience is distributed as follows:

- Males make up 80% of bettors, while females make 20%

- 50% of bettors range in age from 18 to 34 (average age is 38.1)

- 67% work full-time

- 45% make over 75 thousand US dollars

While men make the bulk of bettors, women are becoming more active and catching up: according to Earthweb statistics, every third of women bets on sports.

In terms of the audience age, it's not hard to see a trend toward the younger demographic. In the past, we referred to the average bettor as a man of 25 to 42 years old, but now that age ranges from 18 to 34. A number of factors play a role in it:

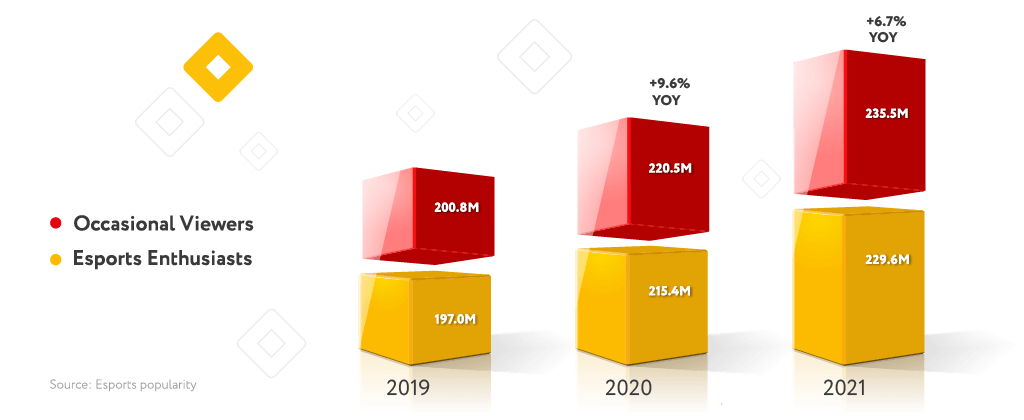

1. The growing interest in the esports industry. As the rising star in sports betting, esports can compete even against the king of sports betting – the all-time favourite football. Sports betting is becoming increasingly popular among young people who watch esports tournaments and play in video games. Target audience of sports gambling is growing, and it is a win for bookmakers seeking to expand their market.

We define occasional viewers as individuals watching professional esports content less than once a month; esports enthusiasts watch esports more than once a month.

2. Younger audiences are more technically savvy, flexible, and open to new ideas. Fortunately, the younger generation now has a basic sense of reliability when it comes to the internet, new tools, and applications. As a result, they are more likely to try new things in the online space, including sports betting.

3. Sports betting plays a gathering or cultural role in several societies. Historically, sports betting has been considered a more socially acceptable form of gambling, even a traditional social activity. It's no coincidence that horse racing is one of the most popular sports in the UK and UAE, same as cricket in India. As a result, the next generation grows up with a sense of familiarity when it comes to sports betting.

Sports Betting Target Markets

In general, the geography of bettors is not much different from the geography of casino players above – the overall gambling statistics are similar and globally follow the same trends. However, certain promising markets with substantial growth deserve special attention.

1. Nigeria

Nigerians are known for their love of sports, especially football, due to their historical and cultural background. It is for this reason that sports betting is the primary focus of development in this region, whereas casinos already play a complementary and reinforcing role.

It is not only a cultural context but also a technological framework that influences the form of sports betting in the region. Traditionally, sports betting requires less internet traffic and is easily accessed from mobile devices, which is pretty in sync with the current state of Nigerian telecommunications.

According to figures from Business Wire, Nigeria has 169 million mobile phone users, and 80% of them use smartphones to access the internet. Increasingly, sports betting operators are realising that providing players with a mobile-friendly option to place bets is crucial to capturing and retaining players.

What is more, player engagement in the region is rewarding. In a survey by the News Agency of Nigeria (NAN), 53% of respondents admitted betting every day, making Nigerian sportsbook operators abundant in opportunities in this online gambling market.

2. Brazil

Until recently, Brazil was often called a 'sleeping giant', which is a perfect description of the online gambling potential of the Latin American region and of Brazil itself.

The market is flourishing, and Brazilians are proactively making their way into the industry – statistics bear this out. The Globo study found that Brazilians actively engage in sports betting and bet on them regularly: 42% of players bet on sports 1–3 times per week, and 18% of gamblers bet at least 7 times per week.

What criteria are significant for regional players when choosing a sports betting site? The survey reveals that players place a high value on a provider's fast and convenient payment processing along with well-developed bonus offers.

When entering this market, make sure to keep these things in mind:

- The mobile version of your website or app should handle a large amount of traffic to provide a smooth and seamless user experience for mobile users.

- The list of payment systems offered should reflect regional preferences (Pay4Fun is the most popular e-wallet in Brazil, for example).

- The bonus policy should be implemented to make the gameplay a memorable experience.

While Brazilian players are active, recruiting them does not pay off instantly (about a year on average), which is important to consider when developing a marketing strategy.